Book: The World’s First Stock Exchange

“The inventions of shares of stock and of a stock exchange are arguably as formative to the development of the world we live in as the discovery of the telescope or of the laws of motion. And those financial innovations were born in Amsterdam. Lodewijk Petram takes us back to 1602, when it all began, and shows how the major elements of the financial life of our time came into being. This is a clear and vital book.”

Russell Shorto, Author of Amsterdam: A History of the World’s Most Liberal City

Back cover

The launch of the Dutch East India Company in 1602 initiated Amsterdam’s transformation from a regional market town into a dominant financial center. The Company introduced easily transferable shares, and within days buyers had begun to trade them. Soon the public was engaging in a variety of complex transactions, including forwards, futures, options, and bear raids, and by 1680, the techniques deployed in the Amsterdam market were as sophisticated as any we practice today.

Lodewijk Petram’s eye-opening history demystifies financial instruments by linking today’s products to yesterday’s innovations, tying the market’s operation to the behavior of individuals and the workings of the world around them. Traveling back to seventeenth-century Amsterdam, Petram visits the harbor and other places where merchants met to strike deals. He bears witness to the goings-on at a notary’s office and sits in on the consequential proceedings of a courtroom. He describes in detail the main players, investors, shady characters, speculators, and domestic servants and other ordinary folk, who all played a role in the development of the market and its crises. His history clarifies concerns that investors still struggle with today, such as fraud, the value of information, trust and the place of honor, managing diverging expectations, and balancing risk, and does so in a way that is vivid, relatable, and critical to understanding our contemporary financial predicament.

“This book is a wonderfully textured account of the rise of stock trading in seventeenth century Amsterdam. It is replete with the personalities, circumstances, wisdom, and folly of the men who fashioned from nothing our modern world of derivatives, repos, and naked short selling. It can be read for pleasure as well as instruction.”

Gregory Clark, University of California, Davis

Media coverage of The World’s First Stock Exchange

The World’s First Stock Exchange was featured in various podcasts and television documentaries. Notable examples of television documentaries include the episode on The Netherlands in the series History Erased on History Canada (S02:E04), and an episode on entrepreneurship in the 17th-century Netherlands for the South-Korean channel EBS. NPR’s Planet Money podcast made a story about Isaac le Maire, the first man in history who went naked short on stocks: The Very First Short. (See also the blog post on this topic.) Moreover, Trailblazers with Walter Isaacson made a story about the history and future of the stock exchange, also featuring The World’s First Stock Exchange.

“Petram’s informed and lively account of Amsterdam’s 17th-century securities market demonstrates that when it comes to investing and speculating we have not progressed much in four centuries. Although a company’s dividend may sometimes have been paid in East Indian spices as well as cash, in most respects Dutch financial markets were surprisingly modern, with not just shares and bonds, but also forward contracts, derivatives, even repo financing with haircuts. And, of course, the Dutch experienced frauds, bankruptcies, crises, and corporate governance problems. While modern Wall Street may have succeeded Amsterdam as the leading market, what goes on there is hardly new.”

Richard Sylla, NYU Stern School of Business

The World’s First Stock Exchange in Dutch, Chinese, Korean and Greek

More on The World’s First Stock Exchange

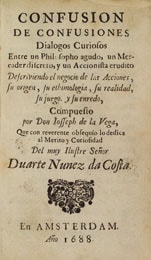

Confusión de confusiones

The World’s First Stock Exchange starts and ends with a chapter on Confusión de confusiones — a world-famous and highly mysterious book on the Amsterdam stock exchange. Joseph de la Vega wrote it in 1688, making it the world’s oldest book about the stock exchange business.

Confusión de confusiones consists of a series of dialogues between an experienced stock trader, a merchant and a philosopher. The stock trader explains to the others the workings of the stock market, tells them about the different types of transactions, and warns them of the tricks and deceptions they must watch out for if they enter the fray. Confusión de confusiones makes for an intriguing read. It shows that the stock exchange captivated the inhabitants of seventeenth-century Amsterdam and also that the share traders engaged in a variety of complex transactions.

But how, exactly, did the stock market work? And how did it develop so quickly after the founding of the Dutch East India Company (VOC)? On the basis of correspondences and other documents of traders who were active on the Amsterdam stock exchange, The World’s First Stock Exchange tells the fascinating story of the development of the market and its crises, and finally sheds new light on Joseph de la Vega’s famous book.

Persons

Dirck van Os | One of the wealthiest merchants of Amsterdam and co-founder of the VOC. He lived on Nes, a narrow street close to Dam Square. His house is an important location in financial history, because this is where the public subscription to the capital of the VOC took place—the world’s first IPO. During the month of August, 1602, the company bookkeeper entered 1143 names into the share register, an imposing volume with deckle-edged pages and a vellum cover.

Hendrick Staets | A broker who was involved in negotiating many share transactions. Staets and his fellow brokers were present on the exchange on a daily basis. They had good knowledge of the market. They knew which dealers were willing to buy or sell shares and at which price. Staets owned a beautiful canal house on Herengracht.

Joseph Deutz | Descendant of an extremely wealthy merchant’s family. Joseph Deutz dealt in pitch, tar and oxen, but at a later age he mainly came to the exchange to deal in shares. Deutz kept meticulous records of all his dealings. His books still exist today, revealing the workings of the market in great detail. Deutz also lived on Herengracht, a few houses down the canal from Staets.

Locations

New Bridge | The northernmost bridge over Damrak, currently opposite to Amsterdam’s Central Station. In the early seventeenth century, this bridge was the location where the merchants of the city gathered every day—in the open air! This bridge is also the place where share dealers negotiated the world’s earliest share transactions.

Hendrick de Keyser Exchange | From 1611, the merchants of Amsterdam conducted their trading activities in this new, specially designed exchange building on Rokin, just south of Dam Square. It was built over the watercourse of the Amstel River. Merchants gathered here during opening hours to trade hides, timber, silk, salt and many commodities more. Right at the back of the exchange, shares were bought and sold.

Dam Square | The exchange was only open for a few hours per day. However, the share dealers wanted to be able to trade instantly when news or rumours about the reached the city. They therefore continued their dealings on Dam Square after closing time of the exchange and regularly went to the inns on Kalverstraat in the evenings.

Read more about the locations of the 17th-century share trade in this blog post.

Documents

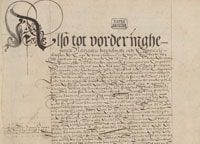

Share register of the VOC Amsterdam chamber | This is the first page of the register that holds the names of all 1143 investors who subscribed to the IPO of the VOC Amsterdam chamber in 1602. They became the first shareholders of the company. The text on this page lists some details of the company and states—very importantly—that the shares in the company could be traded. Read more about this document in this blog post.

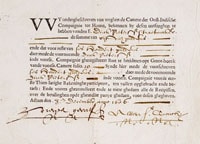

VOC-share | The investors of the VOC had to produce the sum of their subscriptions in four installments between 1602 and 1606. When an investor had paid his last installment, he received a receipt. These receipts are generally known as the world’s oldest shares, but they could not be traded and were certainly not valid proof of ownership of a share. Read more about this document in this blog post.

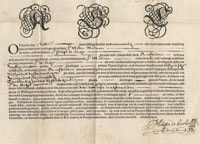

Forward contract | The Amsterdam stock exchange developed rapidly. Within years after the founding of the VOC, the share dealers started trading derivatives. They soon became familiar with trading options, repo’s and forwards. Using these derivatives, it was easy to create highly leveraged positions in the VOC. A number of traders ran enormous risks on the market and it would be only a matter of time before the first stock market crises occurred. Read more about the derivatives trade in this blog post.