share trade

-

The world’s first IPO

The Dutch East India Company (VOC) held its ‘initial public offering’ (IPO) in August 1602. It was the first of its kind in world history and therefore a key event in financial history, and the history of the capitalist world. A public share issue The IPO had been announced in the VOC charter—the company’s founding document of March 20, 1602. “All the residents of these lands,” stated article 10, “may buy shares in this Company.” Subscribers could decide for themselves how much to invest: there was no minimum or maximum. The next article stated that posters would be put up announcing the IPO. There had been companies before the VOC…

-

Going short in 1608

Buying a stock, or taking a ‘long position’ in financial jargon, is what you do when you expect the price of that stock to go up. If, on the other hand, you expect the price of a stock to go down, you can take a ‘short position’. This can be done by borrowing stocks from a third party and then selling these. When the price indeed goes down, you can buy the stocks back at a lower price before returning them to the lender, and thus make a profit. Nowadays, this is an everyday activity for many stock traders, made easy by the services of brokerage firms. Remarkably, it was also daily practice in…

-

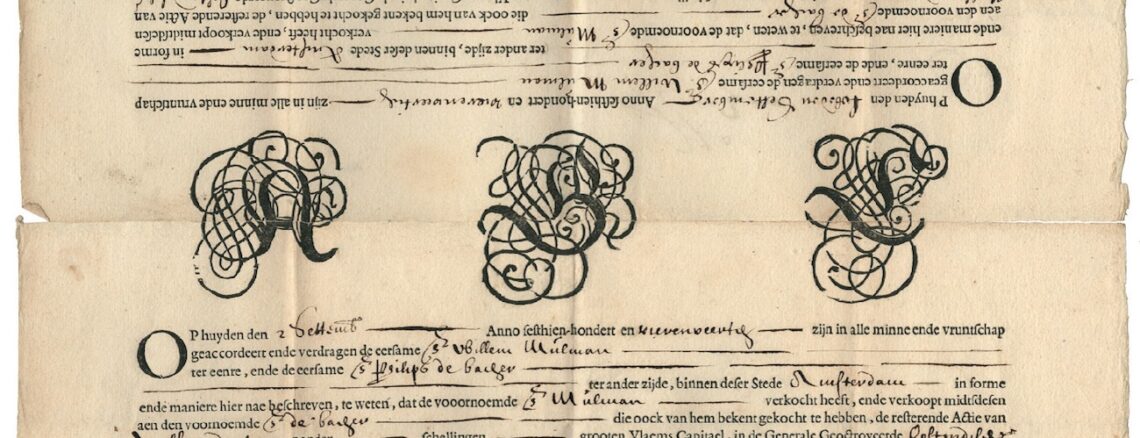

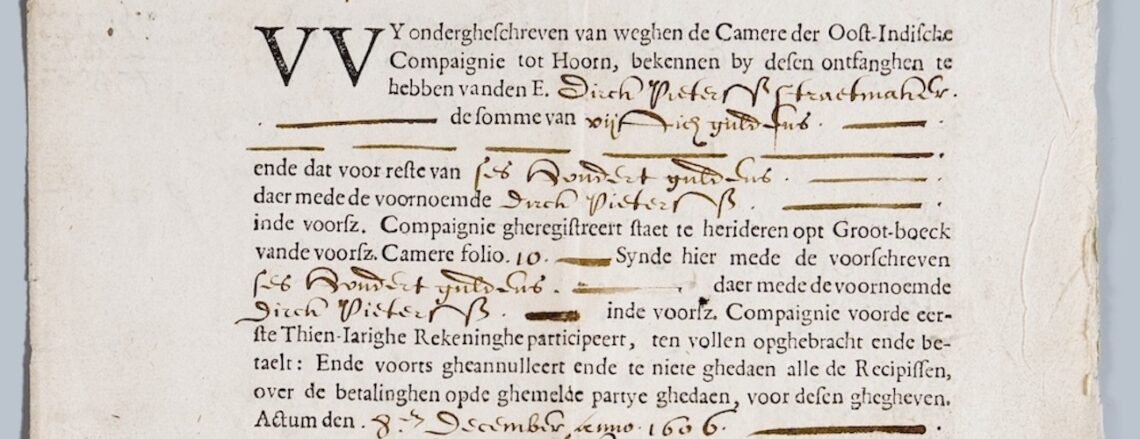

The oldest share

The VOC was the world’s first company whose shares were actively traded. It would therefore make sense that the world’s oldest share certificates had been issued by the VOC. It is not quite like that, however. The VOC charter of March 1602 stated that the company would issue registered shares. Subsequently, the introduction to the capital subscription ledger of August 1602 explained the procedure for transferring the ownership of a share. (Read more about these documents and the IPO of the Dutch East India Company in this blog post.) When two share traders had struck a deal, the buyer and the seller (or their authorized representatives) had to appear together…

-

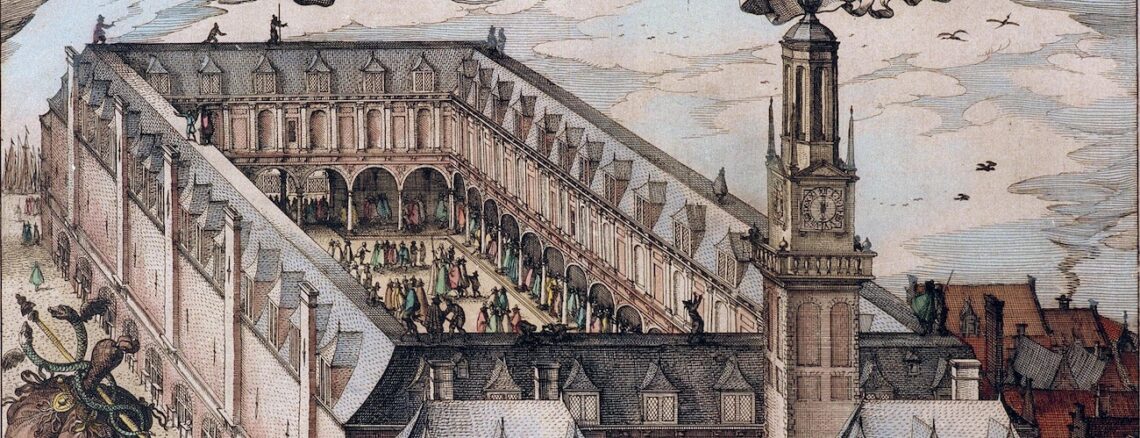

The VOC and Amsterdam’s first exchange building

This image shows the exchange building of Amsterdam in the early-modern era, known as the Hendrick de Keyser Exchange, after the building’s architect. It no longer exists. After two centuries of subsidence problems, the city decided to tear it down in the 19th century. It used to stand just south of Dam Square, where it was built over the watercourse of the Amstel River—small vessels could pass underneath. This had probably been too ambitious for the early 17th-century builders and caused the subsidence problems. From August 1611, when the exchange building opened, this was the place where most share transactions were negotiated. But it was not a stock exchange as…

-

Confusión de confusiones (1688): a historical stock exchange drama

Confusión de confusiones, published in Amsterdam in 1688, is the world’s first book on the stock trade. Ever since the Financial Times included it in its list of ‘Ten Best Books Ever Written on Investment’ (January 28, 1995), interest in this book has soared. It is certainly a very special book, and it definitely stands out from the titles that are usually picked for such lists. But can it serve as a guide to modern investors, as the Financial Times suggested? Dialogues between a merchant, a philosopher and a share trader There are three characters in Confusión de confusiones. Two of them, a merchant and a philosopher, have heard about the trade in shares…