The world’s first IPO

The Dutch East India Company (VOC) held its ‘initial public offering’ (IPO) in August 1602. It was the first of its kind in world history and therefore a key event in financial history, and the history of the capitalist world.

A public share issue

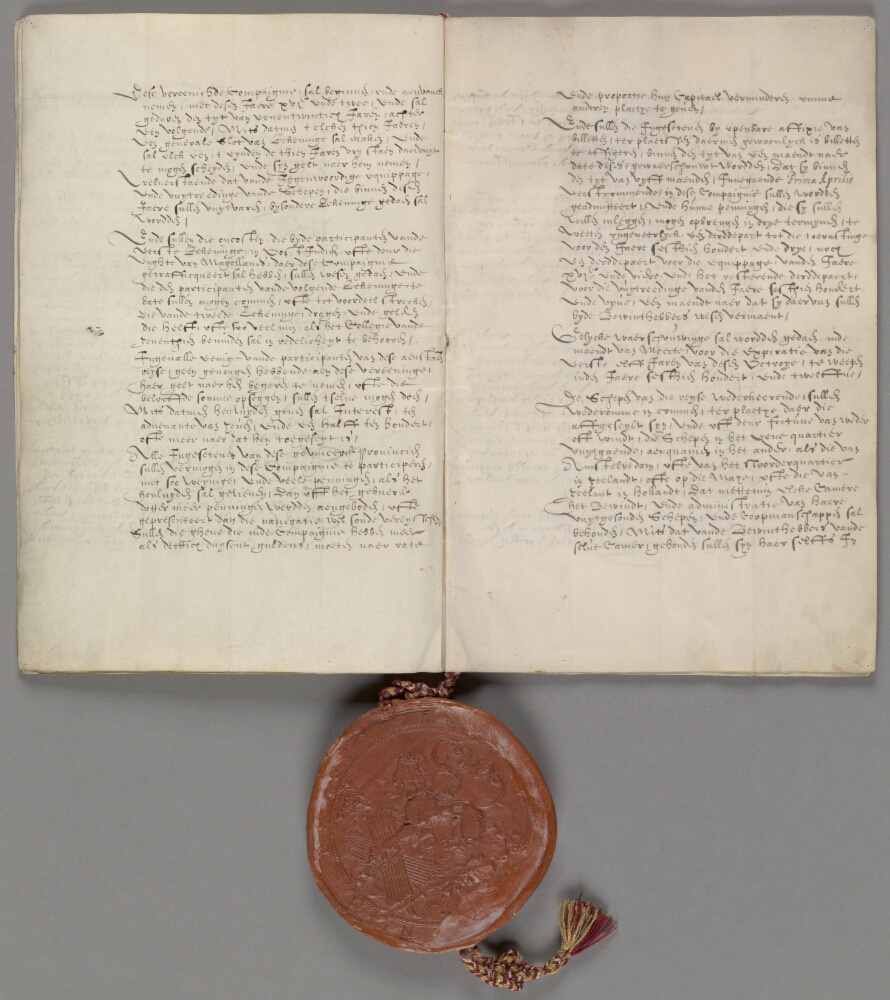

The IPO had been announced in the VOC charter—the company’s founding document of March 20, 1602. “All the residents of these lands,” stated article 10, “may buy shares in this Company.” Subscribers could decide for themselves how much to invest: there was no minimum or maximum. The next article stated that posters would be put up announcing the IPO.

National Archives, The Hague, VOC archives. License: CC0.

Click on the image to browse the full charter.

There had been companies before the VOC that had issued shares—the so-called ‘pre-companies’ that merged into the VOC in 1602 had private shareholders, and their financial structure was modelled on earlier shipping companies in the Southern Netherlands and Italian city-states like Genoa and Venice. What sets the VOC apart from these earlier companies, is first of all the public character of the share issue. Every Dutchman was invited to invest. This was a big difference from the previous companies, which had raised their capital from a small circle of private investors around the directors.

Rijksmuseum Amsterdam. License: CC0

A cosy setting

The scale of the share offering was unprecedented. The setting, however, must have felt familiar. As the VOC did not yet have its own offices, investors in the Amsterdam branch were invited to come to the private house of the wealthy merchant Dirck van Os, co-founder of the VOC, to subscribe money to the company’s initial capital. During the month of August 1602, Van Os and the other directors took turns to oversee the bookkeeper as he entered investors in the register.

Hoogheemraadschap Hollands Noorderkwartier, Heerhugowaard. License: unknown.

The founding directors of the VOC were well-known merchants. This likely contributed to investors’ willingness to put in money. This is important because it is not obvious that people were enthusiastic about the new company. Some of the pre-companies had been highly profitable, but unlike those companies, the VOC was supposed to wage war against the Portuguese in Asia, which would cost a lot of money. Also, because the States-General were seeking resilience and a permanent Dutch presence in the Orient, the VOC was supposed to stay in business for a long time, much longer than any of its predecessors.

Money locked up for 21 years

The company’s first charter was granted for 21 years. In the event, the Company existed for much longer—almost two centuries—but compared with the average lifetime of its predecessors, twenty-one years seemed like an eternity. The precompanies usually operated for three or four years. The cargoes were auctioned off when the flotilla returned, and if the ships were still in good condition they were sold to a new enterprise. The accounts were drawn up, and the investors were paid their share of the proceeds.

The authors of the charter must have realized that this long horizon might deter some interested individuals from investing their money, so they included a provision for the interim liquidation of the VOC. After ten years—in 1612—a “general balance” would be drawn up. In other words, the Company would disclose how it was doing, and shareholders would have the option of asking for their money back.

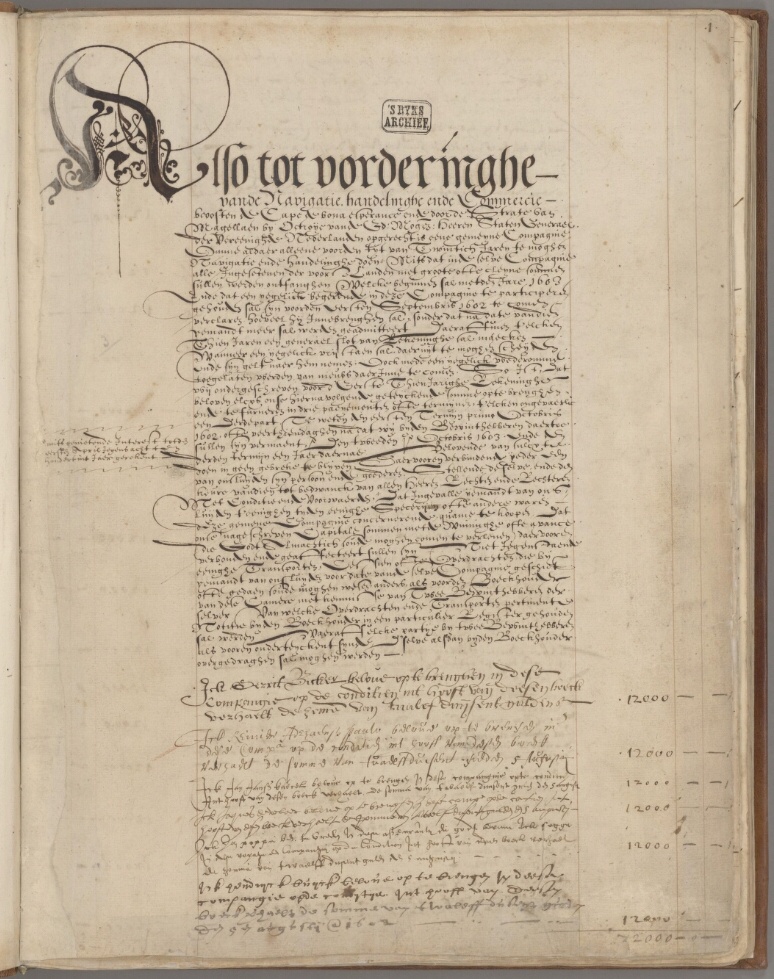

Tradable shares

At some point between the granting of the charter on March 20, 1602, and the opening of the share registers on August 1, the directors realized that ten years was also a long time. Investors might well be wary of committing their money for such an extended period. On the first page of the capital subscription register they therefore included an extra provision: “Conveyance or transfer [of shares] may be done through the bookkeeper of this chamber.” The subscribed capital could be transferred to someone else! This had probably also been possible with the earlier companies that had issued shares, but never before had it been stated so explicitly in an official document that shares could be traded. This provision meant that investors did not have to wait until 1612 before they could get their hands on the capital they had invested. If they wanted to, they could sell their shares before that. The procedure for doing this was also set out on this page. Shareholders had to present themselves to the bookkeeper of the chamber where they had deposited their money, and two directors had to give their approval for the conveyance. The bookkeeper would make “accurate notes” of the transfers “in a special register.”

National Archives, The Hague, VOC archives. License: CC0.

Click on the image to browse the full subscription ledger.

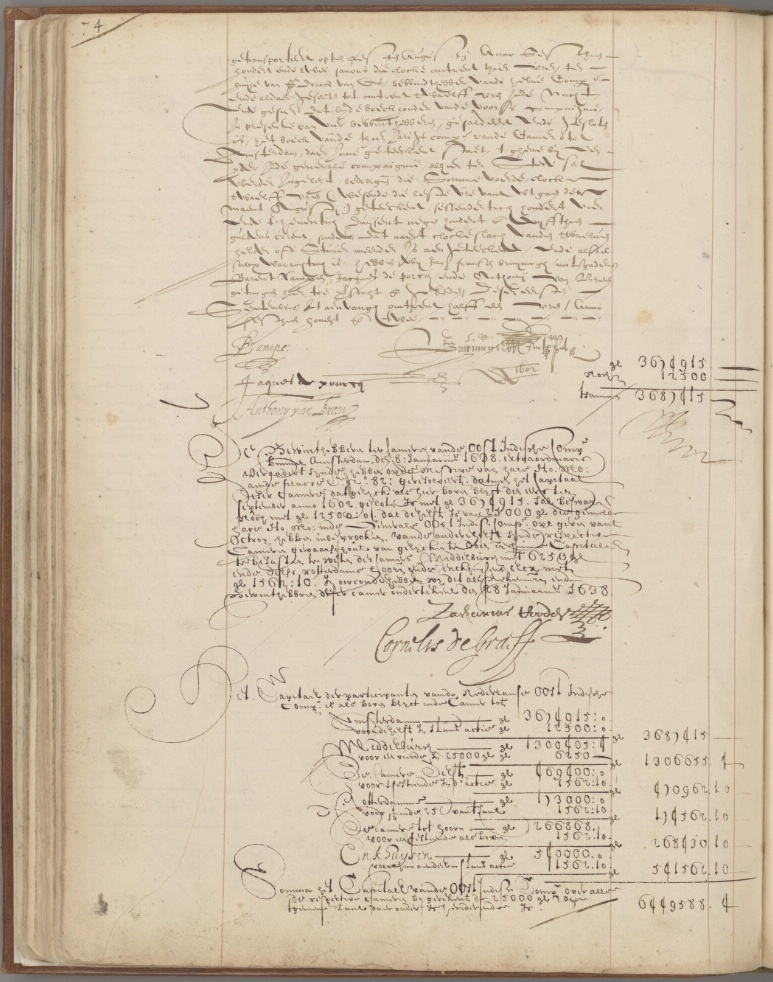

1,143 investors, including two maids

When the IPO closed on August 31, 1602, 1,143 investors had subscribed to the initial capital of the Dutch East India Company’s Amsterdam branch. The second to last subscription was made by Neeltgen Cornelis. She was Dirck van Os’s maid and had seen investors coming and going all month. She subscribed a hundred guilders, for which she had had to work long and hard: her wages were less than fifty cents a day. This seems to have inspired the bookkeeper Barent Lampe to pay his servant a bonus. The very last entry in the book reads “Barent Lampe for Dignum Jans __ 50 guilders.”

When these last subscriptions were registered, notary Jan Fransz Bruyningh, embarked on his closing statement in the book. He wrote that he and his two witnesses had overseen how all the amounts in the register had been tallied, that on the stroke of mid- night a total sum of 3,674,945 guilders had been subscribed, and that not a nickel or dime had been paid in after twelve o’clock.

National Archives, The Hague, VOC archives. License: CC0.

Click on the image to browse the full subscription ledger.

There were six semi-independent branches of the VOC, and each held its own IPO. Of the total amount raised in August 1602—almost 6.5 million guilders—Amsterdam provided 57 percent of the total capital, followed by Middelburg with 20 percent and the remaining four chambers with considerably less: Enkhuizen contributed 8 percent, Hoorn 7 percent, Delft 4 percent, and Rotterdam 3 percent. It is quite possible that the prevalence of the Amsterdam chamber in the company’s initial capital would have been even greater were it not for the fact that there had been a serious outbreak of the plague in the city during the summer of 1602, and consequently many people had fled the city. Only the shares of the Amsterdam branch (and to a lesser extent the ones of the Middelburg branch) were later actively traded.

Related posts

Read more about the founding of the VOC and the role played by the government of the Dutch Republic in the foundation of the company in this post.

The initial capital of the Dutch East India Company, furnished by the subscribers to its IPO, was not capital stock as issued in IPOs today. Read more (TBA soon).